Tratta Contact Center: Two-Way Messaging with Consumers + Email Flags in Reports

📬 Introducing Tratta Contact Center

We're excited to launch Contact Center, a new feature that brings two-way messaging between your agents and consumers directly into Tratta. No more switching between email, phone, and other tools to manage consumer communications. Every interaction is documented in one place for compliance and audit purposes.

What is Contact Center?

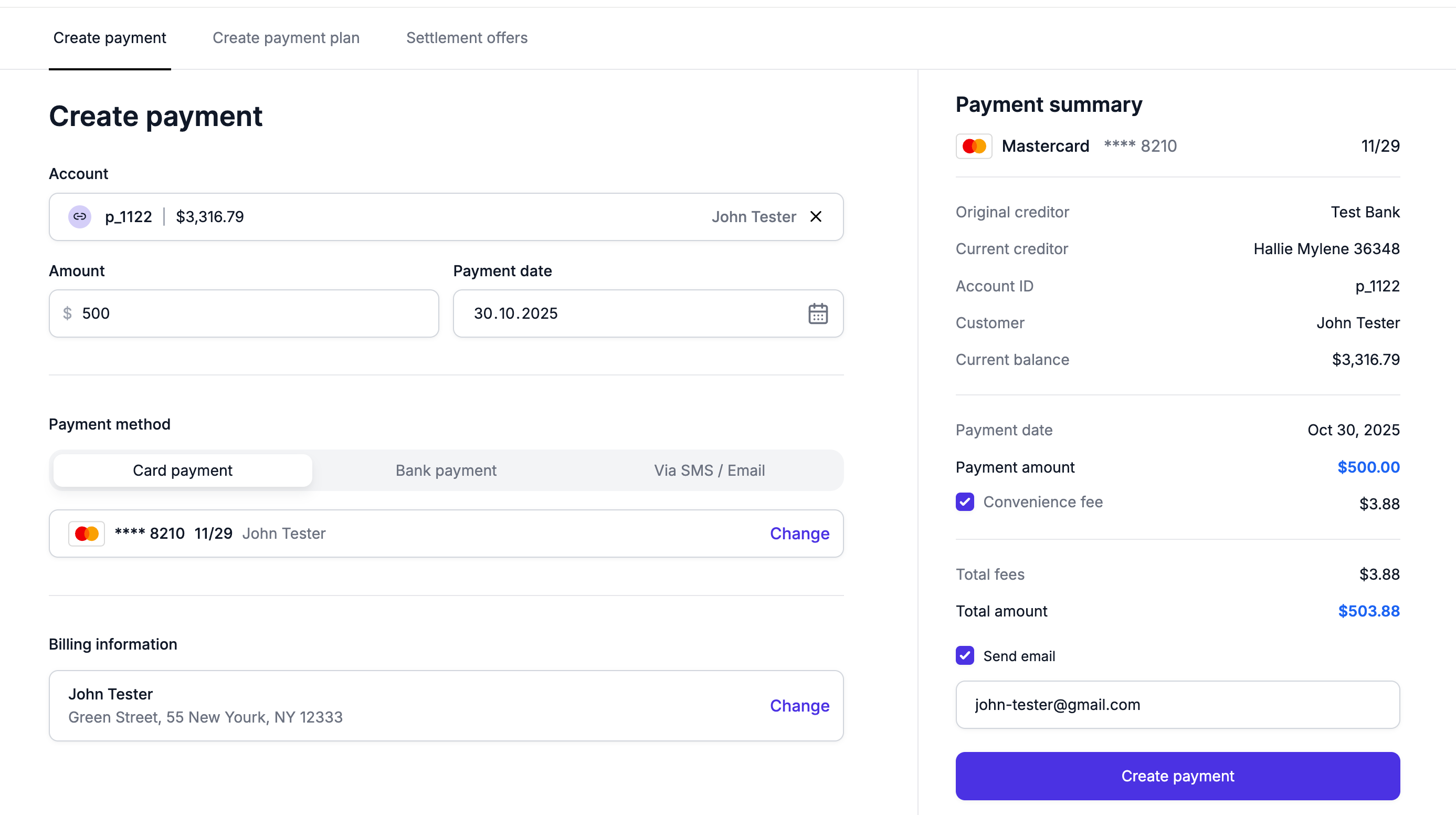

Contact Center transforms the existing contact forms (on the Customer payment portal) into a full ticketing system. When a consumer submits a contact request, it becomes a ticket that agents can manage, respond to, and resolve, all from Console.

Key Features

For Agents in Console:

- Unified inbox: View and manage all consumer tickets in one place (Console > Contact Center)

- Ticket management: Track status (Open, In Progress, Resolved) and assign agents

- Two-way messaging: Reply directly to consumers with text and attachments

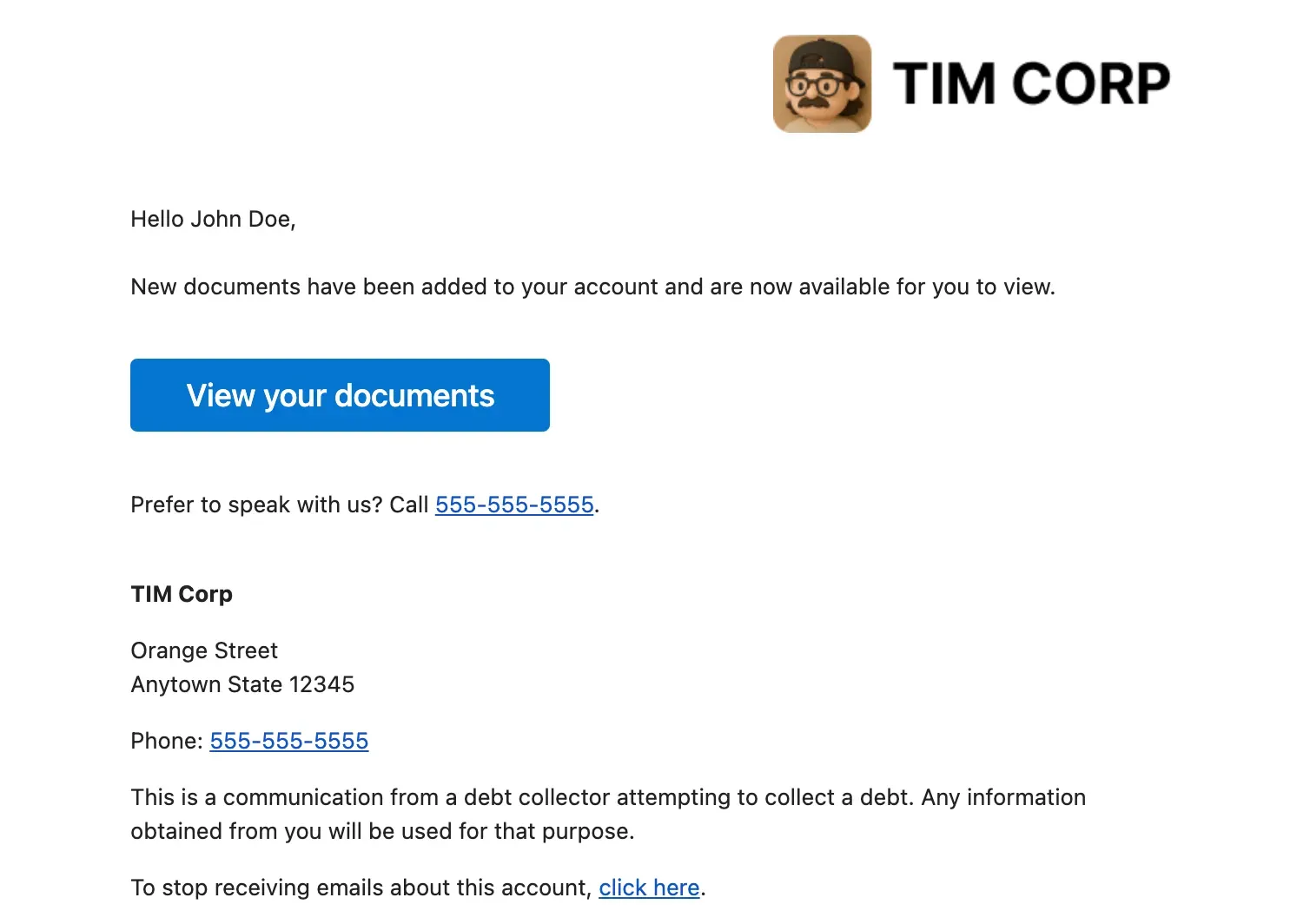

- Secure messaging option: Send notifications without exposing message content in emails (”secure message” feature)

- Quick access: View tickets from Customer and Account detail pages

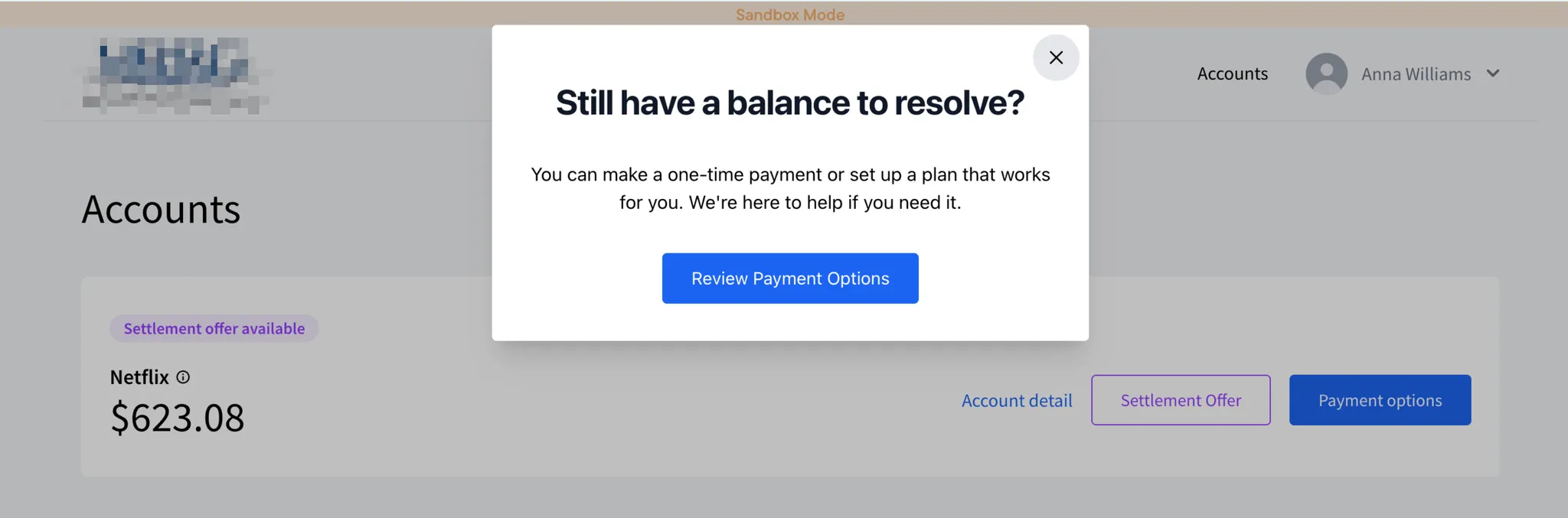

For Consumers in Collect:

- Contact Center section: Consumers can view all their conversations and create new tickets

- Message notifications: Unread message count displayed in navigation

- Reply via portal or email: Consumers can respond from Collect or directly reply to email notifications

🚀 To get started, contact your account manager to enable Contact Center for your organization.

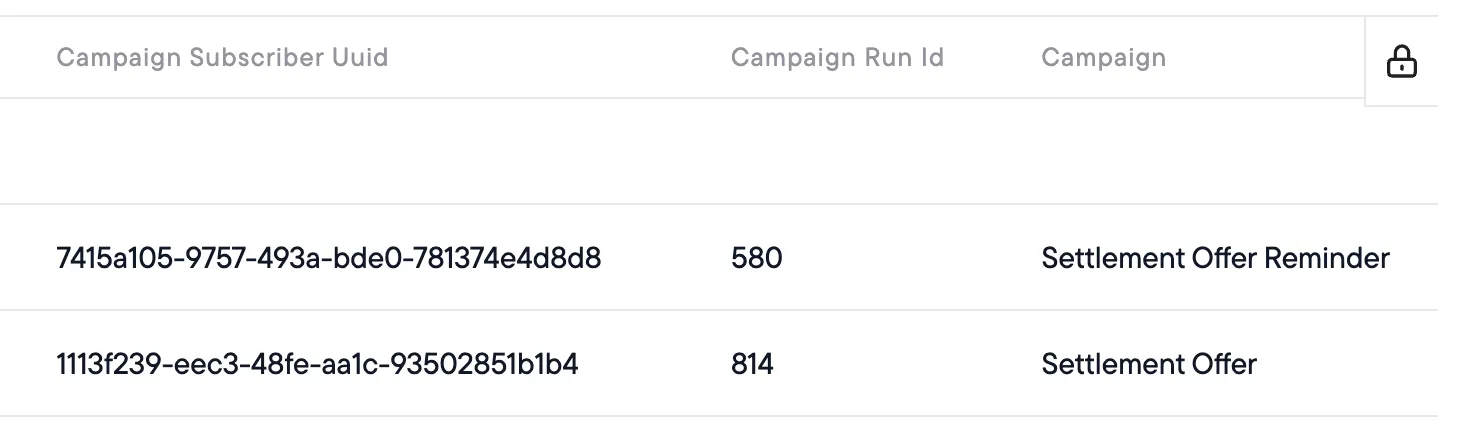

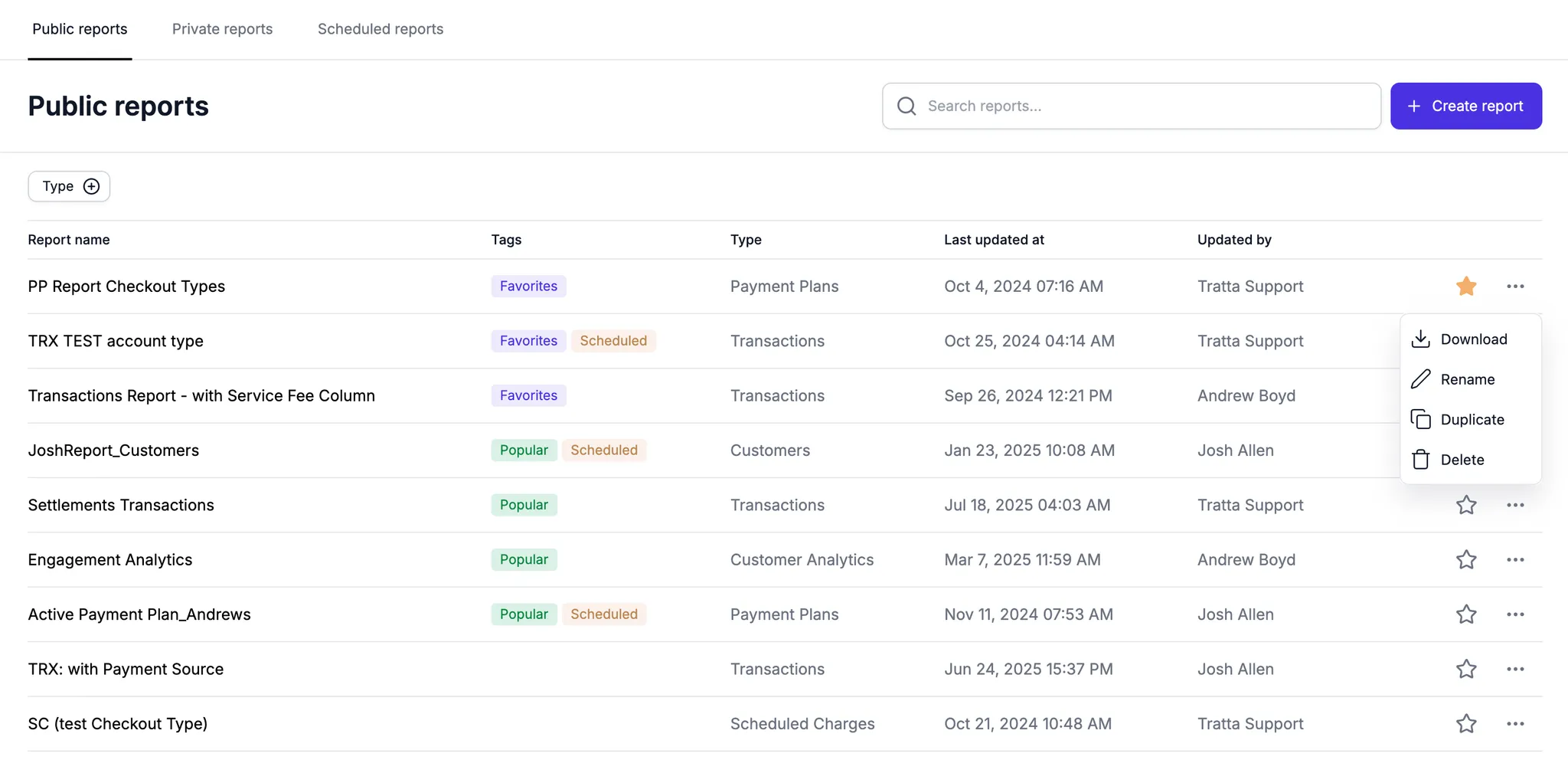

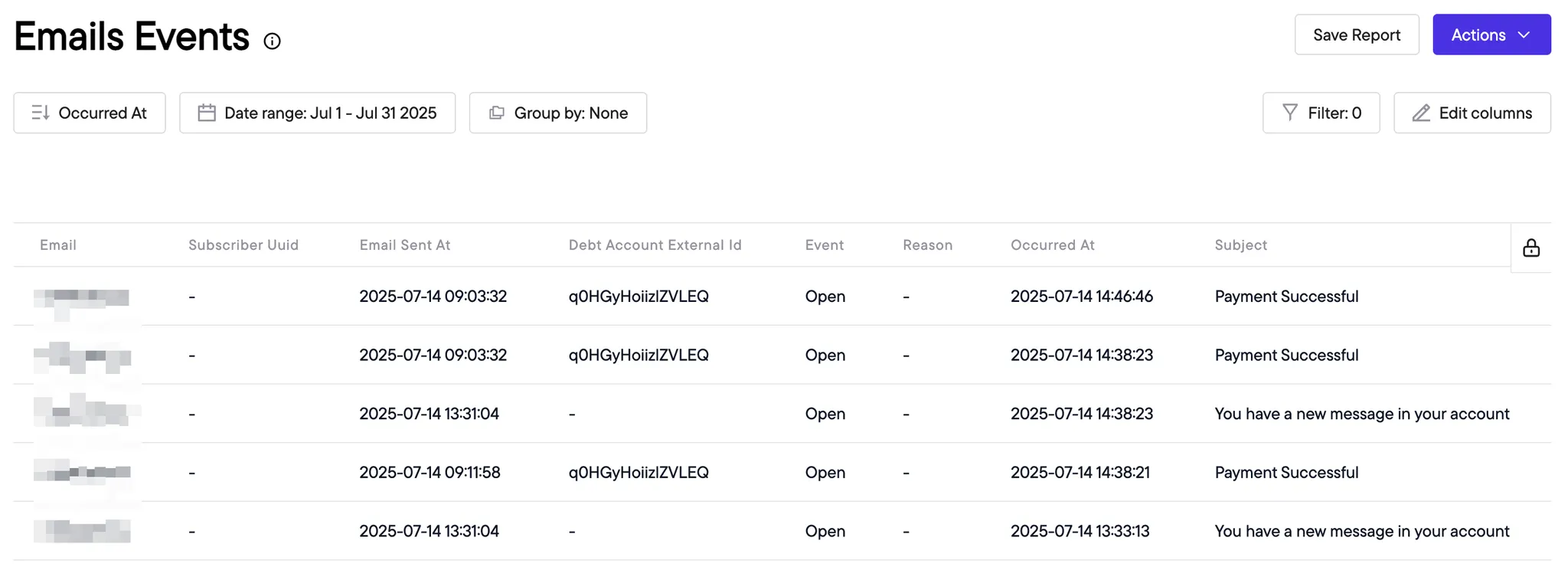

📧 Email and Reminder Flags in Reports

Ever wonder, "Was an email sent for this transaction?"

You can now add new columns to your reports showing whether a confirmation email was sent and whether a consumer is enrolled for reminder emails. This helps you identify which consumers may need physical letters instead - useful for compliance documentation and audit trails.

New columns available in reports:

- Transactions: Email Sent (charge confirmations)

- Scheduled Charges: Email Sent (payment reminders), Email Enrolled*

- Payment Plans: Email Sent (enrollment confirmation), Email Enrolled*

*Email Enrolled shows Yes/No based on whether the consumer has an email address and reminder notifications enabled.

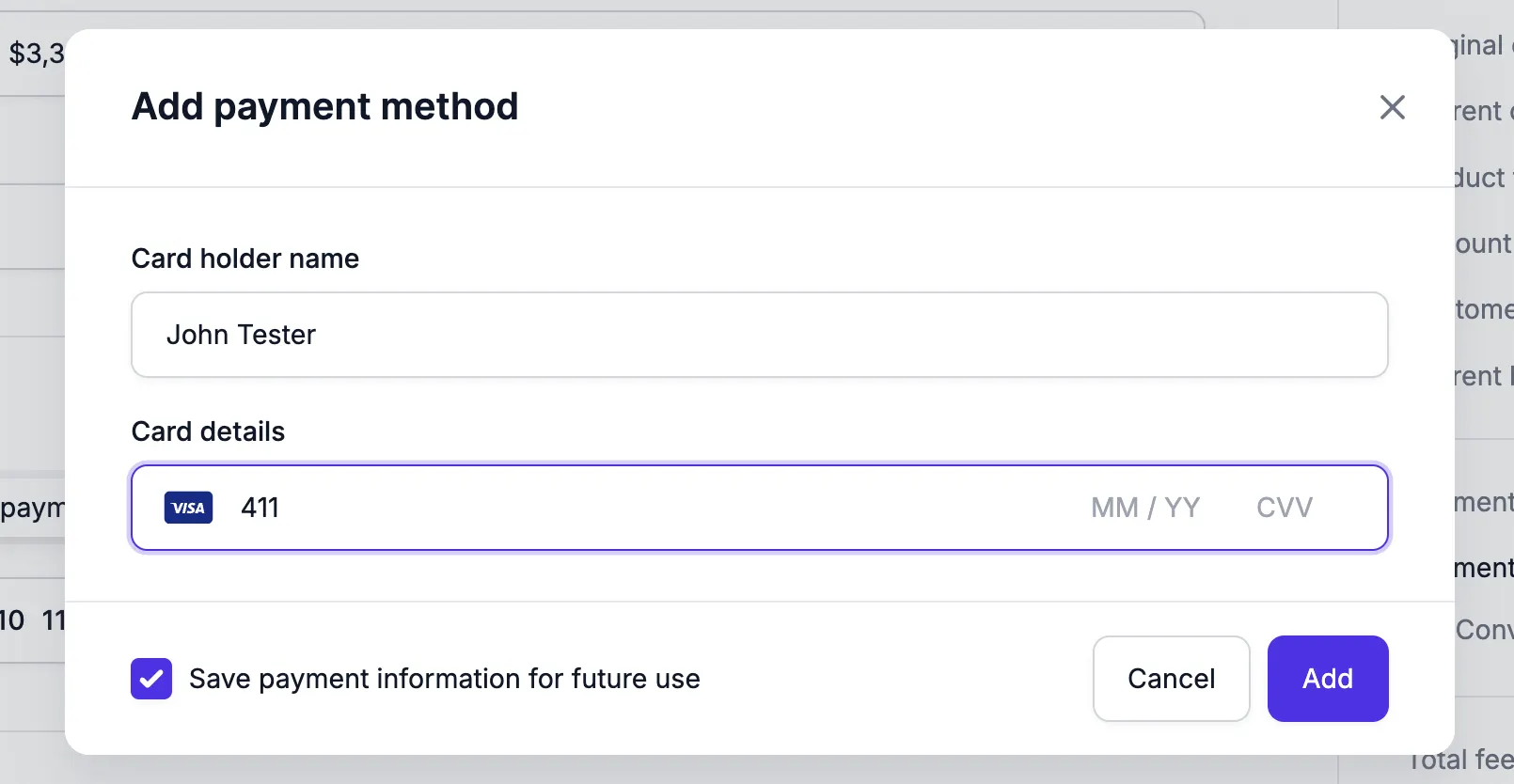

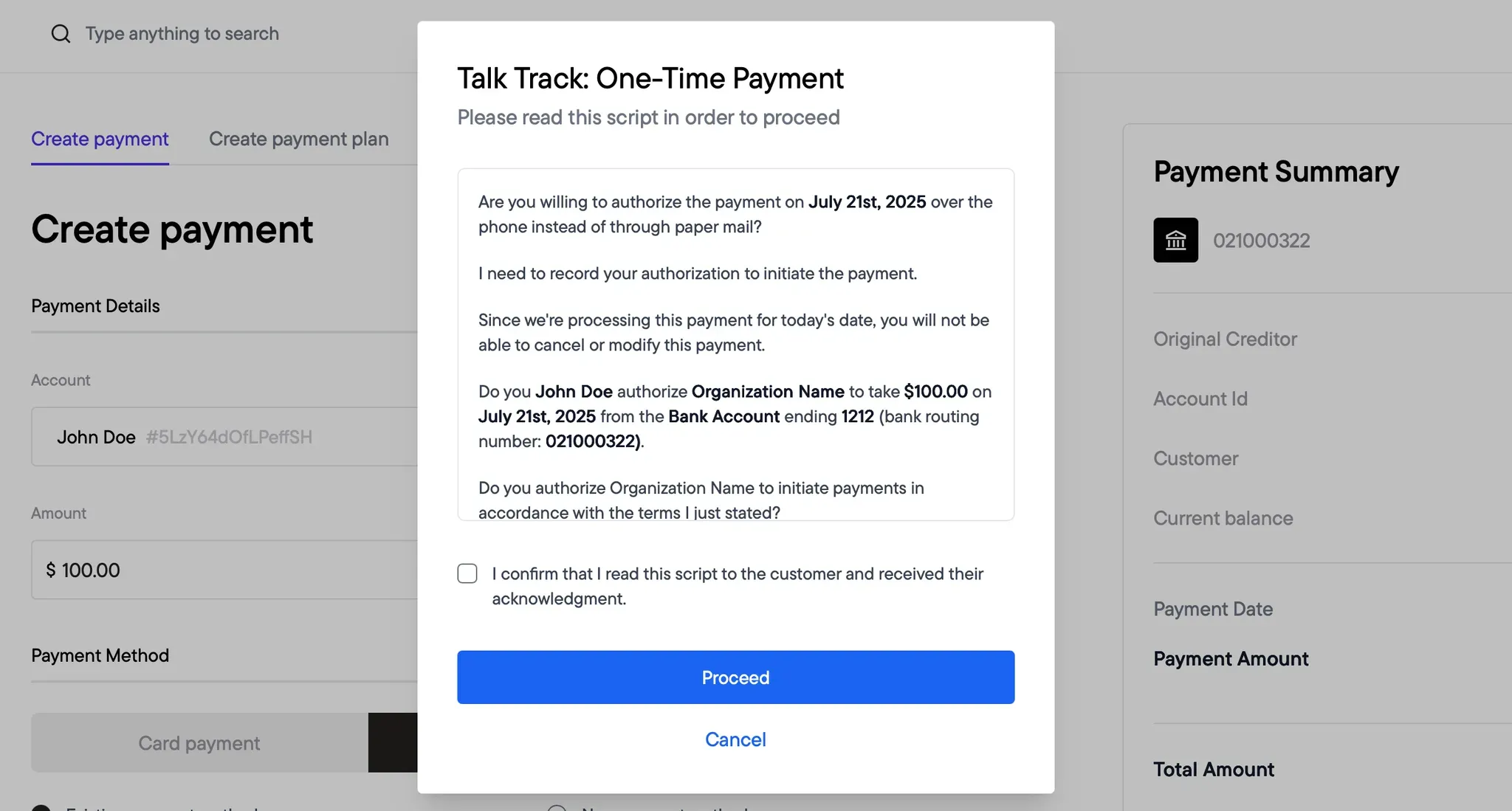

🏦 New Variable for Full ACH Account Number in Payment Authorization

You can now include the full bank account number in your Payment Authorization popup using the new variable {{bank_account_number_full}}. This is useful when agents need to read back the complete account number during phone authorization for payment verification.

Only agents with the "Unmask Bank Account Number" permission can see the full number.

Stay tuned for more updates! 💫